The true cost of machinery ownership

When setting out a yearly budget, the machinery section should show costs to be split up into five separate sections: fuel, lubrication, maintenance, repairs, and labour. These sections make up the Operating Costs, or the cost of using the machine. In this article, we shall look at how we can use these figures, and then how to calculate the true ownership costs.

The total costs of owning a machine include the operating costs and fixed costs.

Operating costs are the cost associated with using the machine for its intended use, e.g. mowing.

Fixed costs are those that have to be paid even if the machine is parked in a locked building and not used.

Operating Costs

To calculate the operating costs of using machinery and equipment, the following costs need to be calculated:

1. Fuel

2. Lubrication (greases and oils)

3. Maintenance (regular servicing)

4. Repairs (damage from accidents and misuse)

5. Labour (maintaining and repairing the machine)

This can be a daunting task and highlights the necessity of keeping good records. I used to set this as an assignment exercise when I was teaching and it taught those enthusiastic, outdoor loving greenkeepers that the "paper work" was important after all!

The following guide may help to gather the correct information for each section.

1. Fuel

i. Determine how much fuel the tank holds

ii. Fill the tank before mowing and, afterwards, look inside the tank to calculate how many litres of fuel is used per cutting session

iii. Calculate the number of cuts per year

iv. Find out the fuel cost per litre

Multiply the amount of fuel used per cut (ii) by the number of cuts per year (iii), and then multiply by cost of fuel per litre (iv).

2. Lubricants

Oils

i. Find the quantity of engine oil, axle oil, hydraulic oil etc. in the machine. This may be from the Service Manual or from the manufacturer's website (see Useful Websites below for guidance)

ii. Determine the number of times the machine is serviced during the year and calculate the quantities of oil used per service and multiply by the number of services

iii. Find the cost of a barrel of oil and calculate the cost per litre (price paid divided by the quantity of oil in the barrel in litres)

iv. Multiply the quantity of oil used (ii) by the cost of oil per litre by per year (iii)

v. To this figure (iv) add the cost of oil used during normal use, e.g. engine oil topped up during the year

Grease

i. Find cost of grease per tube

ii. Calculate number of tubes used per year

iii. Multiply cost (i) by number used (ii)

Add up the costs for oils and grease to determine the total cost of lubricants.

3. Maintenance

Calculate the cost of parts used during regular servicing as listed in the Service Manual, e.g. cylinder grinding, replacement bottom blades and filters.

4. Repairs

This section should include the cost of parts and materials used in carrying out repairs caused by misuse or accidents, e.g. burst hydraulic pipes, welding, punctures etc.

5. Labour

Cost of labour per hour of the person who carries out maintenance and repairs, multiplied by the number of hours spent maintaining and repairing the machine.

Useful websites

The following is a guide to the manufacturer's sites that offer full access to Operator and Service Manuals. Be aware that some manufacturers allow full access to information for machines sold only in the United States. They may be slightly different to the machine you use, even though it is the same model.

www.deere.com

• Worldwide sites

• UK/Ireland

• Golf & Turf

• Servicing and support

• Operator's Manuals

• Golf & Turf Equipment

• Select a category and follow the links to your machine

www.ransomesjacobsen.com

• Customer Care

• Technical Manuals

• Scroll down and click on correct machine

• You have a choice of manuals

www.toro.com

• Make sure you are in the UK/English section

• Golf Course Management

• Customer Care

• Use the links to find and download the required manuals

www.hayter.co.uk

• Mowers for Commercial Use

• Operator's/Parts Manuals

• Select the correct machine

• Download the required manual

(this is not a comprehensive list and does not imply that any other sites are of less value)

How can these figures be used?

Keeping a record of all these costs requires discipline, but is worth the effort. The following uses can be made of the figures:

• By comparing the costs year to year, an assessment can be made on the efficiency of the machine

• Budgets can be accurately forecast

• A turf manager can show they are requesting funds based on financial evidence

The last point is crucial to the professional standing of Turfgrass Managers. It is of no use to approach the Club Manager or Director with a request to replace a machine, "because it is knackered". A professional manager needs to learn to speak the language of the person who signs the cheque.

Worksheet 1 (below) is an example of comparing figures over three years. The figure are clearly set out and the hourly cost to operate the machine is shown to be increasing. Further presentations of the figures could include a graph to show the past three years and future projections of costs.

Worksheet 2 shows another use of the figures. This time a comparison is being made against the first year use of a new machine. The figures will be estimates based on the servicing schedule in the manual and costs of part from the supplier. An estimated figure is inserted in the repairs section to cover accidental damage.

How can we use these figures to justify the cost of purchasing a new machine?

Turf managers need to understand that most of the people who sign the cheques need to be happy that the company or organisation is going to benefit from spending a large amount of cash. They need to be sure that this money is an investment, not a cost.

In my first Head Greenkeeper job, the greens mower was costing a total of £3,500 to maintain and repair. A new machine was calculated to cost about £850 per year to operate, the difference between the two figures being £2,650. In other words, it would cost the company £2,650 less to operate a new machine, and that figure would appear as extra profit on the Profit and Loss account. If £18,000 was spent on a new machine (early 1990s prices) the percentage return on the money spent would be 14.7%.

If the company was to invest £18,000 in an interest earning bank account it would have got about 12% at the time. Now I was talking a language the financial controllers could understand, and not going on about cylinder regrinds, oil changes and vibration.

Going further

The figures looked at so far are the operating costs. To calculate the overall cost of owning and operating the machine we need to include further costs, i.e. the fixed costs. These are:

1. Depreciation

2. Storage

3. Insurance

4. Cost of finance

1. Depreciation

Depreciation of an asset, e.g. machinery, is the loss in value each year of ownership. Although no actual cash is involved, depreciation is counted as a legitimate business expense and appears on the Profit & Loss account as a cost. Depreciation can be calculated in two ways:

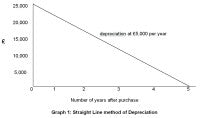

a) A fixed amount every year over a given time period, e.g. a mower costing £25,000 and depreciated at 20% of purchase price for five years, known as the straight line method.

After five years the machine is worth zero if it is to be traded in as part exchange for a new machine. In reality, the machine is worth something even it is only of scrap value. This is why machinery is depreciated using the declining balance method.

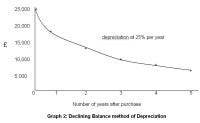

b) The declining balance method is calculated by reducing the value of the machine by a percentage of the value each year the machine is owned, as illustrated:

Purchase price - £25,000

End yr 1 - £25,000 - 25% (£6,250) = £18,750

End yr 2 - £18,750 - 25% (£4,687.50) = £14,062.50

End yr 3 -£14,062.50 - 25% (£3,515.63) = £10,546.88

End yr 4 - £10,546.88 - 25% (£2,636.72) = £7,910.16

End yr 5 - £7,910.16 - 25% (£1,977.54) = £5,932.62

Using this method the machine value does not reach zero and is used to calculate trade-in value against a replacement machine.

Machinery and equipment is normally calculated at 20% or 25% per year. The figures are treated as a business expense and appear on the Profit & Loss Statement. Buildings are often depreciated using the straight line method over twenty five or thirty years.

2. Storage

Not a cost normally factored in when calculating machinery costs. However, machines and equipment are stored in a building, or on land, that cost money to provide and is subject to business rates.

These costs can be calculated by measuring the area taken up by the machine and dividing into the costs of the building. To avoid complications storage is normally calculated at 4% of cost price multiplied by the number of years the machine is owned.

3. Insurance

Insurance required for machinery and equipment will be to cover fire and theft whilst in storage, Employer's Liability to cover injuries to the operator and Public Liability to cover injury to other people or property. Organisations will have different requirements and the manager will need to check which are used.

4. Finance

The cost using the money to purchase the machine also needs to be taken into account. The commonest is the interest rate at which the money is borrowed from a lending institution.

An organisation may use funds not borrowed from a bank, but there is always a cost associated with using this resource. For example, the money could have been left in an interest earning account which would be lost if used to spend in the organisation.

Organisations will have their own method of calculating the cost of using internal funds and the turf manager will need to check with the accountant.

Some of the information for fixed costs may not be available to the turf manager. However, you can be sure these costs will be taken into account by the people responsible for the financial well-being of the organisation.

So of what use are these figures to the turf manager?

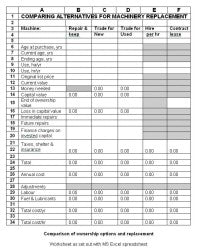

It is vital that a manager presents alternatives to the facility owners. Just to present the costs of replacing a machine with a favourite model will almost always result in the proposal being sent back for resubmission. Alternatives for purchasing and owning machinery should be presented so that the owner has confidence that the manager is investigating the best value for the company. Alternative costs for different options can be set out on a spreadsheet and the alternative methods to provide a machine can be compared (see example).

I have included the four main alternatives for replacing equipment:

1. Repair and keep what you have - this may a viable option if finances are not available in the near future

2. Replace with used equipment - can be a cost effective alternative for budget golf courses

3. Replace with new equipment - the ideal alternative for the Superintendent but may not be the best option for the organisation

4. Hire as and when required - a viable option for equipment used infrequently, e.g. hollow corer or verti-drain

Each option will have its merits and relevance to individual facilities. The aim is to choose the best for the organisation, not just what suits the personal preferences of the turf manager.

Conclusion

Financial management is not the most favourite subject of turf managers. However, I believe it is vital to grasp a working knowledge of finance in order to influence the decision makers that can make it worthwhile for you to get up in the morning. Once the hard work of keeping good records has been set in place, the use of the figures will help any turf manager to get the machinery and equipment they need.

If you require a working copy of the above spreadsheet, please contact Andrew Turnbull, stating the Operating System on your computer, i.e. Windows XP™ or Vista™, through allturfman@ntlworld.com.